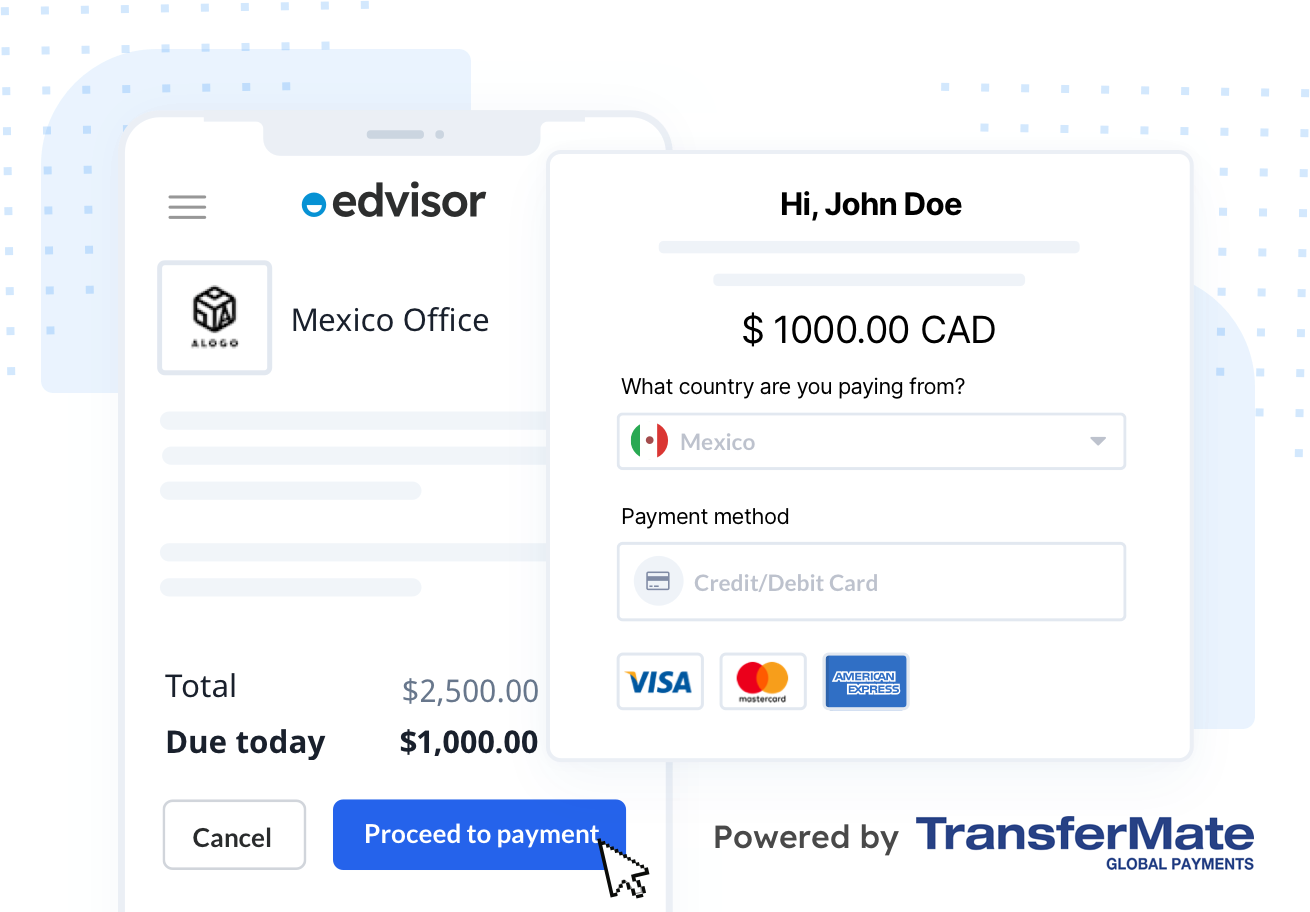

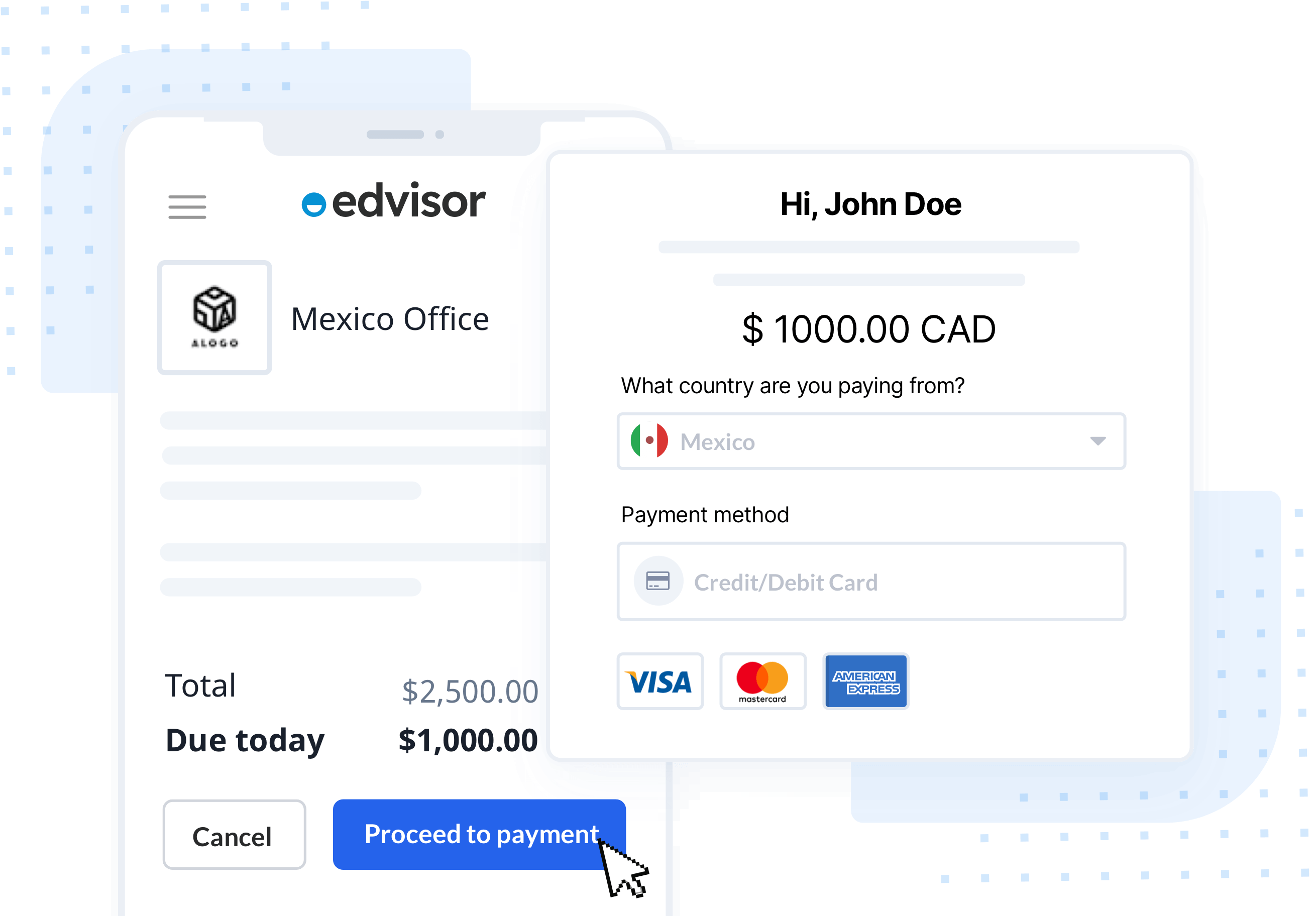

How to Make a Single Payment with TransferMate

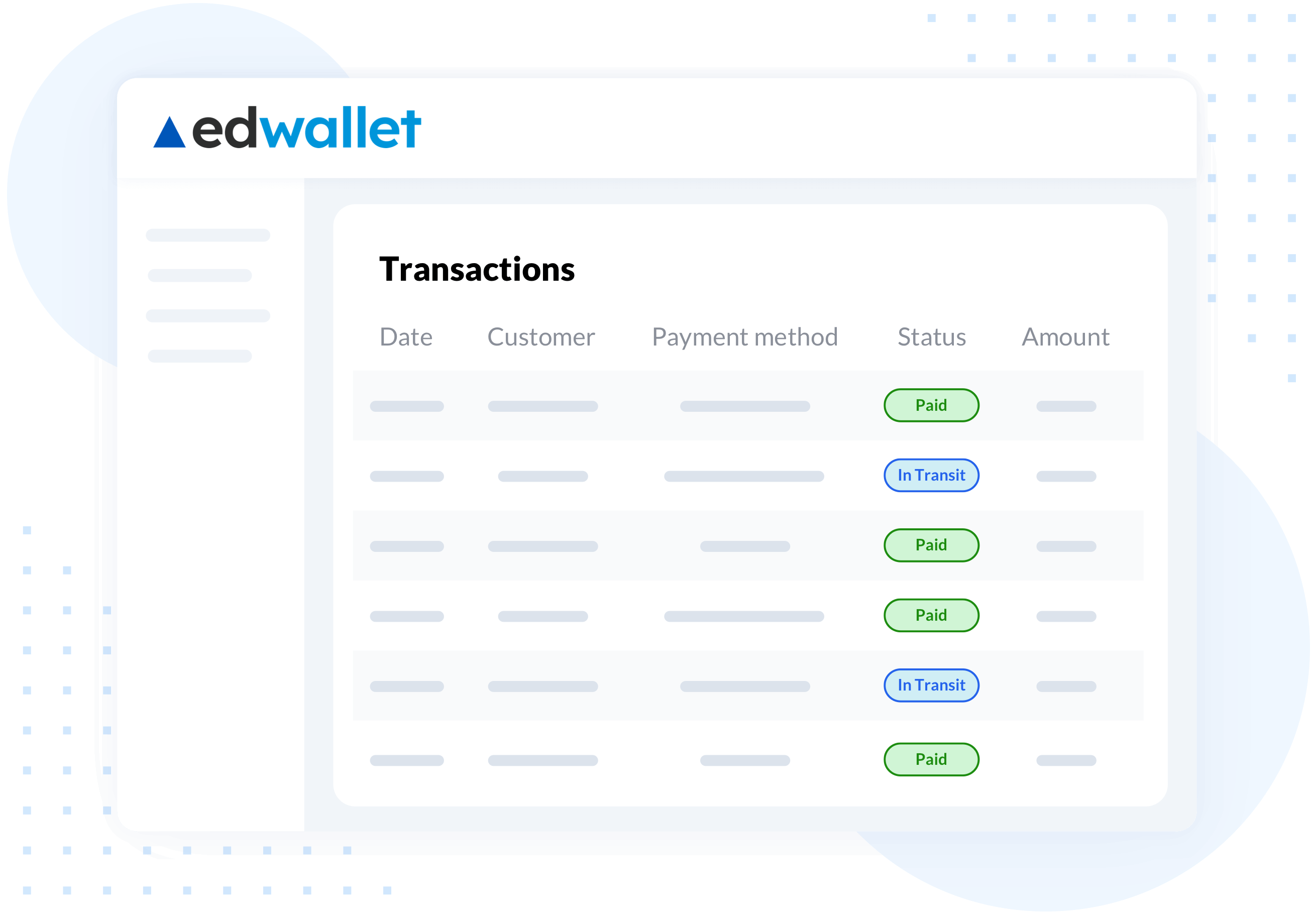

Learn how to sign in to TransferMate, select your payment source, add beneficiary details, and authorize your payment. The video also covers reviewing the payment summary, transferring funds, and completing the transaction with a "Paid" status update.

Download documents